The partners at this firm had a fortuitous experience which, with a little involvement, could have been easily avoided altogether. I only share this to advocate the importance of confirming you are truly following your state’s requirements for handling IOTA/IOLTA (Interest on Trust Accounts / Interest on Lawyers’ Trust Accounts).

Rule #1: Don’t assume that your bookkeeper, billing clerk or legal secretary knows and understands the software they’re using or the Rules that YOU are held and bound by.

Rule #2: The ‘wait period.’ If a client pays by check that check must clear the financial institution prior to the firm making any distributions. Should you not confirm the funds have cleared and you distribute those funds, you could later find out that the check was returned for NSF. Some States mandate a specific amount of days before the firm can reflect a payment from the client trust account on the billing statement as well.

Each state has its own nuances, but the rules generally don’t vary much. For instance, some states do not allow you to accept credit card payments directly into the client trust account, nor pay funds out of that account for filing fees, etc. via a debit card. The latter seems to be prevalent across the board while the acceptance of client payments via credit card has become sanctioned by most states as long as specific rules are followed.

Rule #3: If accepting credit card payments directly to the trust account, the entire credit card payment must be credited to the client’s account and any fees related to the transaction must be taken from the firm’s operating account as a direct expense. You cannot, for any reason, accept that payment in to your Operating account and then transfer it to the Trust. (I have seen this done, so I feel it is worth mentioning).

Rule #4: Obtaining the words “In Balance” at the end of a bank rec is simply not enough. You can be in balance with the bank statement but still have issues in your trust account. Examples would be outstanding checks and even deposits. One must pay attention to all outstanding transactions and determine if they are truly outstanding or errors.

If they are outstanding, you must determine when to void the checks and whether or not the client is now owed a return of his/her trust monies. When we leave these stale checks on our books, it can become increasingly difficult to find the client because people move, pass away, etc. Then there is an entire procedure involved with proving that you made every effort to find that individual. Obviously one should never have an un-reconciled deposit hanging out on the bank rec month after month, but again, I have seen this as well. Perhaps the money was deposited to the operating account but the transaction was entered in the trust account ledger. It happens.

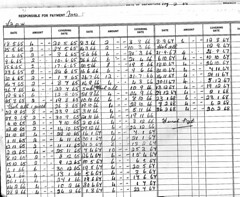

Rule #5: Monthly reports should be printed & reviewed such as:

- The bank reconciliation report showing both reconciled and unreconciled transactions

- Full client trust ledger

- Trust account check register

To summarize, I would encourage all firms to utilize an ABA-approved trust account software program, review their State’s trust accounting rules and regulations and take the time and effort to properly train personnel.

Edie Zimmerman is the Owner of Legal Software Solutions.